The need to check a worker’s status and right to work in the UK has been around for a long time, but the rules and methods have changed regularly, and the penalties are severe. We are here to help you navigate your way through.

Pre-covid, the vast majority of checks had to be done in person, but, of course, during Covid, face-to-face meetings were not possible, so the Government temporarily allowed employers to carry out the checks remotely, using video chat. Of course, the potential for the use of fraudulent documents was increased, and, therefore, the Government wanted to find a balance between the security of an in-person check and the convenience of digital checking. Source – KPMG

As a result, they set up certified digital identity service providers (IDSPs). An IDSP is a government-approved company responsible for assessing and validating the potential employee’s right-to-work documents. A list of these is available on the Home Office website.

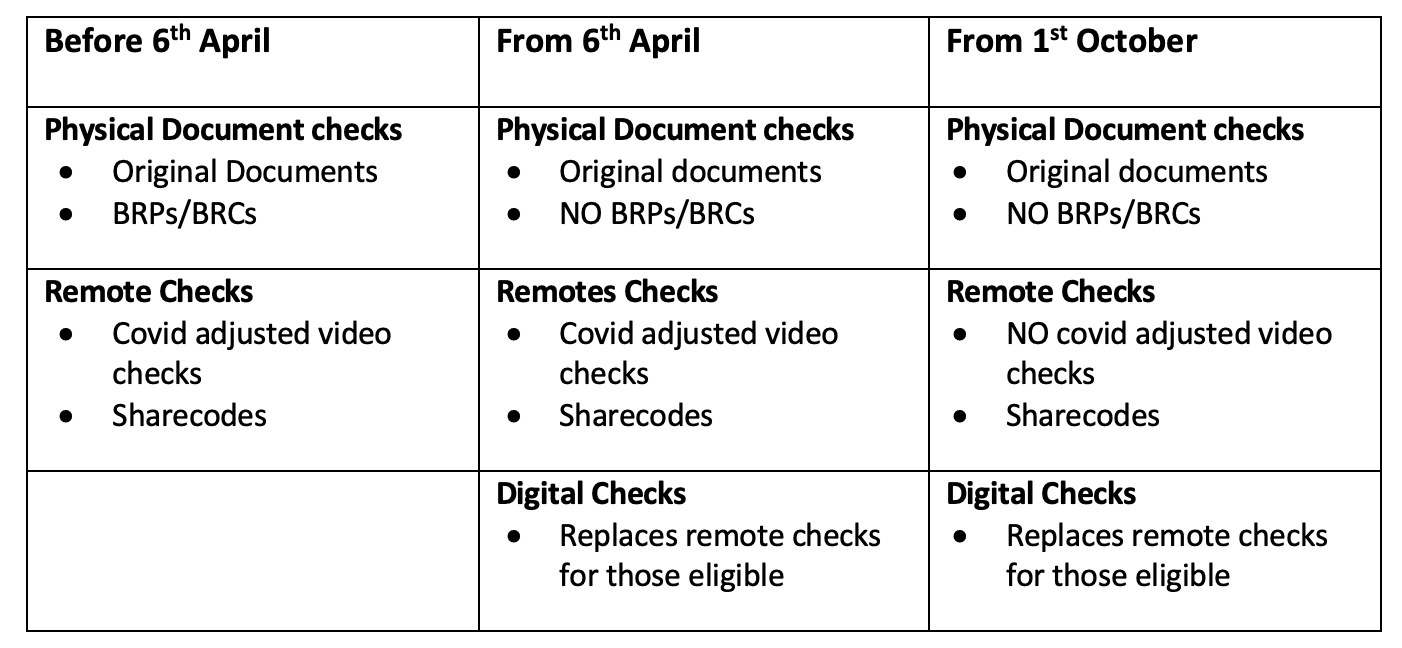

The key dates for the changes are 6th April 2022 and 1st October 2022. TrustID helpfully summarised the changes as follows:

Source: TrustID

Sanctions for not checking properly and for employing illegal workers include a penalty of £20,000 per illegal worker or a five-year prison sentence and an unlimited fine. You could be subject to the closure of your business or have your sponsor licence removed. Also, the earnings gained as a result of the illegal work can be seized. Source: Shoosmiths

At Riddingtons Payroll, we alleviate this additional burden and cost whilst protecting you against any claim or liability. Get in touch for advice and more information.

Please fill out the form below and a member from our friendly team will call you back shortly.